Danny is CoinDesk's Managing Editor for Data & Tokens. He owns BTC, ETH and SOL.

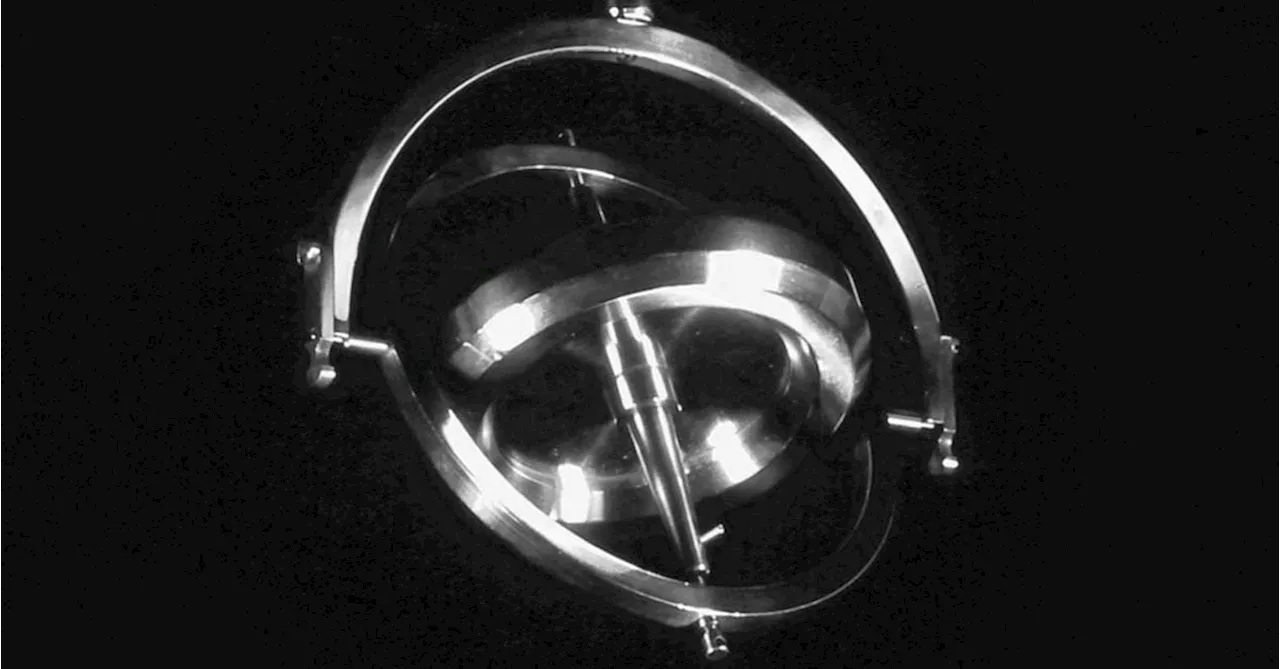

Gyroscope is debuting a high-yield liquidity pool that seeks to generate returns from trading, rehypothecation of assets and loyalty points.Stablecoin project Gyroscope is out with a new piece of trading infrastructure that its developers say will improve capital efficiency for crypto users seeking yield.The new liquidity pool product is called Rehype – short for rehypothecation, the practice of lending out the collateral backing a loan.

The product's existence is a sign of the times in decentralized finance . Forget about the"high yield" 4% APY accounts being offered by traditional banks. In DeFi, risk-loving traders are demanding higher returns on even their stablecoins, the most boring and least volatile crypto asset around. Rehype's core focus will be on providing liquidity for people looking to trade stablecoins. It serves as the"automated market maker" that keeps buys and sells flowing, taking a cut of every trade. Depositors who lend assets to the pool will get a cut of the fees. Gudgeon said the pool will take assets like USDC and USDT.

The final source of yield will be loyalty points from Gyroscope’s new “SPIN program.” Users who participate in the pool will get points based on their activities. Like many points programs, it's the setup for a future distribution of governance tokens.

Nigeria Latest News, Nigeria Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin ApplicationsCrypto Blog

Stablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin ApplicationsCrypto Blog

Read more »

Stablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin ApplicationsStablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin Applications

Stablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin ApplicationsStablecoin Studio on Sui, S3, to Give Sui Developers Compliant Payment Processing Stablecoin Applications

Read more »

Stablecoin Project Ethena Labs Bags $4M for USDe TreasuryShaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Stablecoin Project Ethena Labs Bags $4M for USDe TreasuryShaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Read more »

Existing Stablecoin Models Are Not 'Totally Fair,' Usual CEO SaysUsual CEO Pierre Person answers five rapid-fire questions from CoinDesk, including killer use cases for stablecoins, his journey into the crypto space, and what the MiCA regulation means for traders and entrepreneurs in Europe.

Existing Stablecoin Models Are Not 'Totally Fair,' Usual CEO SaysUsual CEO Pierre Person answers five rapid-fire questions from CoinDesk, including killer use cases for stablecoins, his journey into the crypto space, and what the MiCA regulation means for traders and entrepreneurs in Europe.

Read more »

Stablecoin Standard and Aleph Zero Announce Strategic Partnership to Facilitate the Future of On-Chain CommerceCrypto Blog

Stablecoin Standard and Aleph Zero Announce Strategic Partnership to Facilitate the Future of On-Chain CommerceCrypto Blog

Read more »

Arthur Hayes Clarifies: Ethena’s Yield Mechanism Unique from Terra’s Collapsed UST StablecoinCrypto Blog

Arthur Hayes Clarifies: Ethena’s Yield Mechanism Unique from Terra’s Collapsed UST StablecoinCrypto Blog

Read more »