There’s little tax revenue left to reap in an updated alternative minimum tax. Tax expert Jamie Golombek explains.

It’s a question worth exploring. To begin, keep in mind the budget stats only looked at the federal tax rate and not the combined federal/provincial rate. Currently, there are five federal income tax brackets for 2022: zero to $50,197 of income ; more than $50,197 to $100,392 ; above $100,392 to $155,625 ; over $155,625 to $221,708 ; and anything above $221,708 is taxed at 33 per cent.

Capital gains are only 50-per-cent taxable, meaning that an individual who realizes a one-time gain on the sale of their cottage of, say, $400,000, would have gross income of $400,000, but taxable income of $200,000, because only half the gain is taxable. Absent any other income, the federal tax bill would be about $43,000 and the average federal tax rate would be 10.8 per cent on capital gains.

Next, let’s consider an investor who earns $400,000 in Canadian-eligible dividends. Because of the dividend tax credit, equal to 20.73 per cent of the actual dividends received, the federal tax on $400,000 of eligible dividends would only be $76,000 for an average federal tax rate of 18.9 per cent, which can also lower the average tax rate from the expected rate. Two-thirds of the highest income earners in 2017 reported some Canadian dividends, with the average amount being more than $100,000.

Nigeria Latest News, Nigeria Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

National Muslim charity launching legal challenge of CRA audit, calling it Islamophobic | CBC NewsA national charity that describes itself as Canada’s largest grassroots Muslim organization is launching a Charter of Rights challenge against the Canada Revenue Agency, claiming that a years-long audit of the charity has been tainted by bias and Islamophobia.

National Muslim charity launching legal challenge of CRA audit, calling it Islamophobic | CBC NewsA national charity that describes itself as Canada’s largest grassroots Muslim organization is launching a Charter of Rights challenge against the Canada Revenue Agency, claiming that a years-long audit of the charity has been tainted by bias and Islamophobia.

Read more »

How to dispute a tax decisionObjecting to the CRA can be expensive — here’s how to decide if it’s worth it

How to dispute a tax decisionObjecting to the CRA can be expensive — here’s how to decide if it’s worth it

Read more »

How to dispute a tax decisionObjecting to the CRA can be expensive — here’s how to decide if it’s worth it

How to dispute a tax decisionObjecting to the CRA can be expensive — here’s how to decide if it’s worth it

Read more »

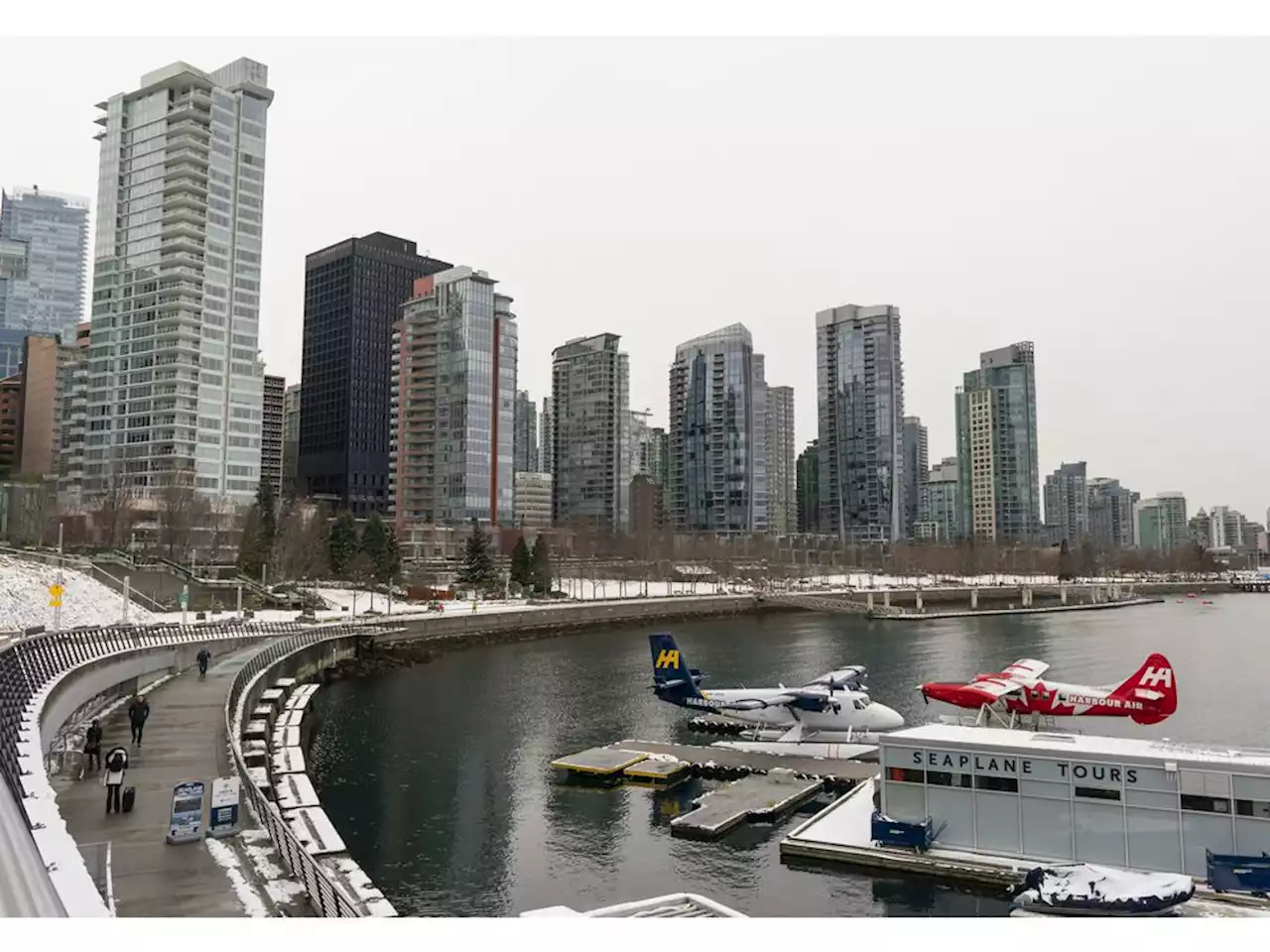

Vancouver council to decide whether to increase empty homes tax to five per centUnder proposal the owner of a $5 million home who chooses to keep it empty will have to pay $250,000 a year in tax, compared to the current $150,000

Vancouver council to decide whether to increase empty homes tax to five per centUnder proposal the owner of a $5 million home who chooses to keep it empty will have to pay $250,000 a year in tax, compared to the current $150,000

Read more »

Multiple-property holders own upwards of 41% of housing in some provinces, Statscan data showThe data from the Canadian Housing Statistics Program include both residential and recreational holdings

Multiple-property holders own upwards of 41% of housing in some provinces, Statscan data showThe data from the Canadian Housing Statistics Program include both residential and recreational holdings

Read more »

National Muslim charity launching legal challenge of CRA audit, calling it Islamophobic | CBC NewsA national charity that describes itself as Canada’s largest grassroots Muslim organization is launching a Charter of Rights challenge against the Canada Revenue Agency, claiming that a years-long audit of the charity has been tainted by bias and Islamophobia.

National Muslim charity launching legal challenge of CRA audit, calling it Islamophobic | CBC NewsA national charity that describes itself as Canada’s largest grassroots Muslim organization is launching a Charter of Rights challenge against the Canada Revenue Agency, claiming that a years-long audit of the charity has been tainted by bias and Islamophobia.

Read more »