Another day, another big swing in Bitcoin to enliven a relatively slow Monday on Wall Street. This time, the digital asset surged 7% to retake $70,000, the latest sign that pronounced Bitcoin moves increasingly fall in US hours.

Raptors return on investment is the real dealMLS Cup the winning goal in record-breaking season for soccer in North AmericaNorth America’s oldest sport catches momentum in new professional localesCanadian Football League fanatics fuel financialsCanada’s Davis Cup team finding love

That pattern was also evident in February after the token scaled $60,000 for the first time since 2021 and in the push to a record in March. The focus of trading has shifted to the US alongside the rollout of Bitcoin exchange-traded funds, which have drawn more than $11 billion in net inflows since their Jan. 11 debut.

The US Bitcoin funds from the likes of BlackRock Inc. and Fidelity Investments rank as among the most successful ETF launches and are altering crypto market structure. The changes include improved Bitcoin market liquidity and a spike in spot volumes around the time the ETFs calculate their net asset value toward the close of the US trading day.

Nigeria Latest News, Nigeria Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bitcoin hits new ATH of $70,220 as volatility spikes, whipsaws back below $68kThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Bitcoin hits new ATH of $70,220 as volatility spikes, whipsaws back below $68kThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Read more »

Spike in Bitcoin Volatility Heralds an Early Test of US ETF DemandBitcoin price swings are becoming more intense following the digital asset’s run to a record high, and a key question now is how investors in US exchange-traded funds for the cryptocurrency will react.

Spike in Bitcoin Volatility Heralds an Early Test of US ETF DemandBitcoin price swings are becoming more intense following the digital asset’s run to a record high, and a key question now is how investors in US exchange-traded funds for the cryptocurrency will react.

Read more »

Bitcoin volatility spikes amid record ETF inflows, analysts say bull market is just getting startedThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Bitcoin volatility spikes amid record ETF inflows, analysts say bull market is just getting startedThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Read more »

Bitcoin’s volatility might rise in the days aheadA large number of previously inactive Bitcoins started moving on-chain, signaling potential volatility and price surges in the days ahead.

Bitcoin’s volatility might rise in the days aheadA large number of previously inactive Bitcoins started moving on-chain, signaling potential volatility and price surges in the days ahead.

Read more »

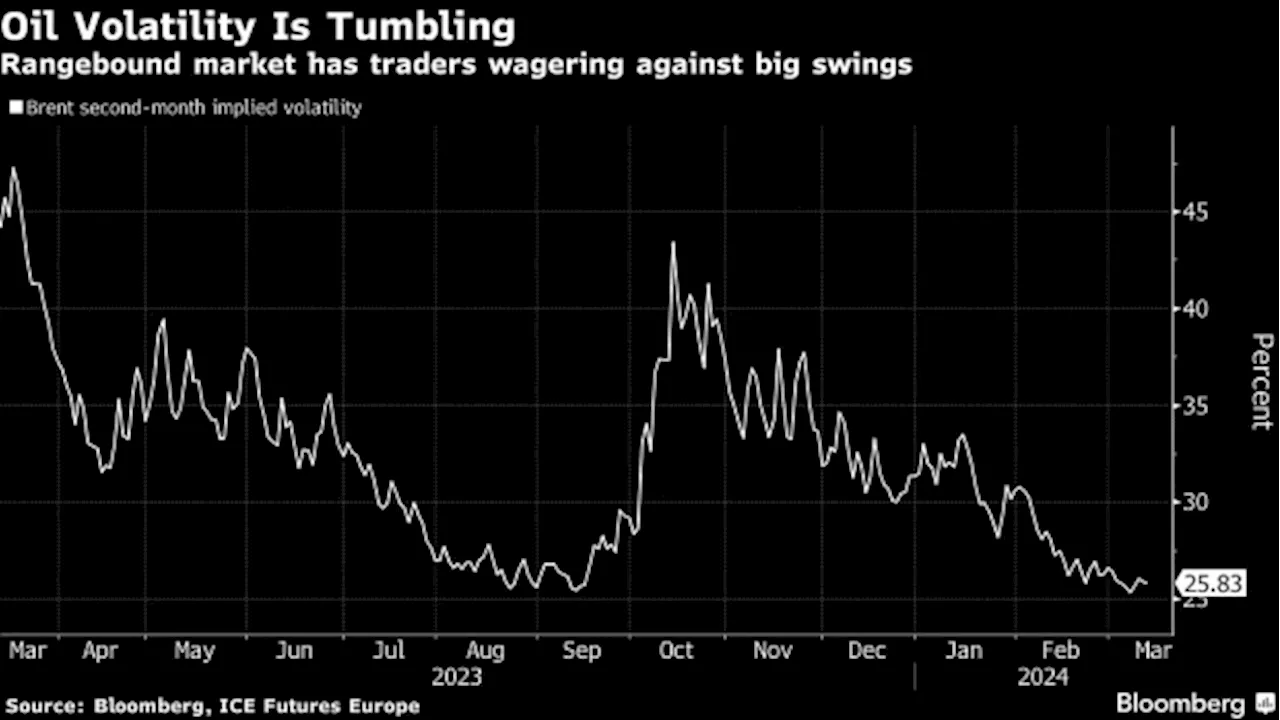

Commodities Get Pulled Into the Global Short-Volatility TradeTraders are betting against volatility in raw materials prices, countering the commodity sector’s notoriously boom-and-bust history.

Commodities Get Pulled Into the Global Short-Volatility TradeTraders are betting against volatility in raw materials prices, countering the commodity sector’s notoriously boom-and-bust history.

Read more »

Fishing for low-volatility dividend stocksIt’s time to introduce the Pickled Perch portfolio

Fishing for low-volatility dividend stocksIt’s time to introduce the Pickled Perch portfolio

Read more »